I recently went to the USA for the first time and, in common with my travel anywhere else, didn't take any foreign currency.

I took the following;

- A Revolut Card

- A Curve Card

- My American Express Card

- My UK Debit Card

I was impressed with the simplicity (and reliability) of the Revolut app, and how much it saved on the trip and put together this quick overview / review for anyone else considering it, or travelling in the future

The Card

The Revolut card is a prepaid Mastercard issued by Paysafe, nothing new there. Where it differs is it allows you to hold balances in multiple currencies; GBP, USD and EUR.

The App

The Revolut card is managed entirely through a mobile app. My experience is with the iOS app, but I believe they also offer an Android version with similar functionality.

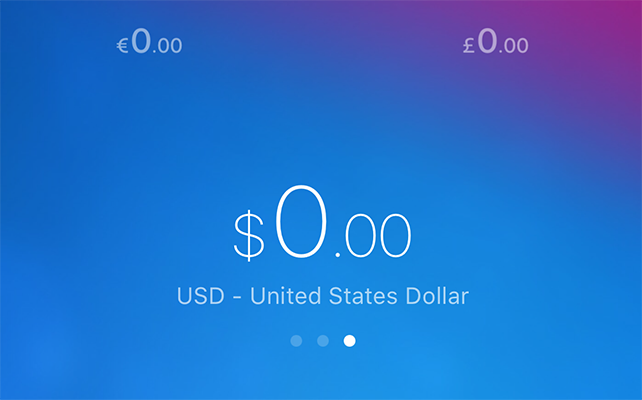

Multiple Balances

The Revolut app allows you to view three independent balances on your card; GBP, EUR and USD. You can also make payments to the card in any of these currencies.

More currencies are supported (I also spent some CAD) and these are deducted from the currency you choose (in my case USD) at a competitive exchange rate and with no other fees.

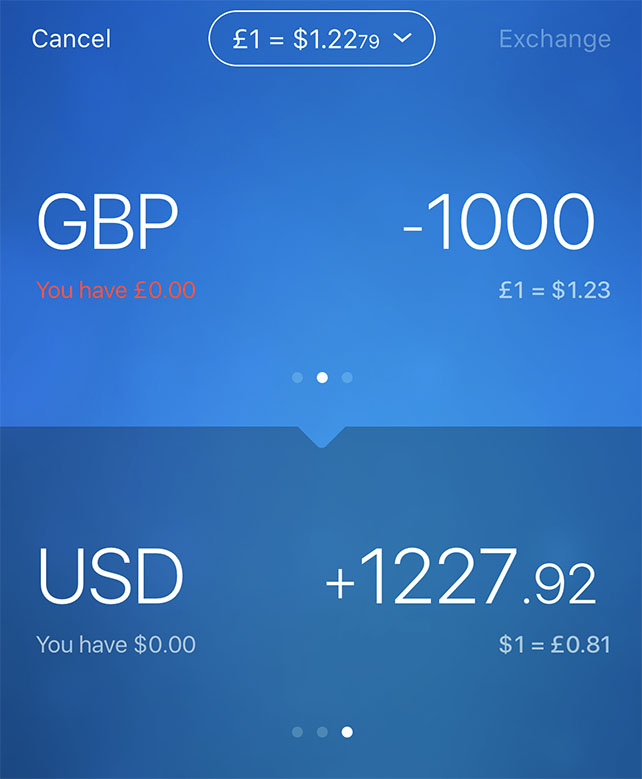

Realtime Exchange Rates

When exchanging money between currencies in Revolut you can often literally see the exchange rate change whilst you're watching, waiting a few seconds can see you gain (or lose) a few $ – it feels like a live currency market.

Conversion from one currency to another is instant, and your balance is available immediately.

There were literally no delays with this in my experience, when I ran out of USD I could top-up with more GBP using my UK debit card instantly and convert it immediately to USD in seconds.

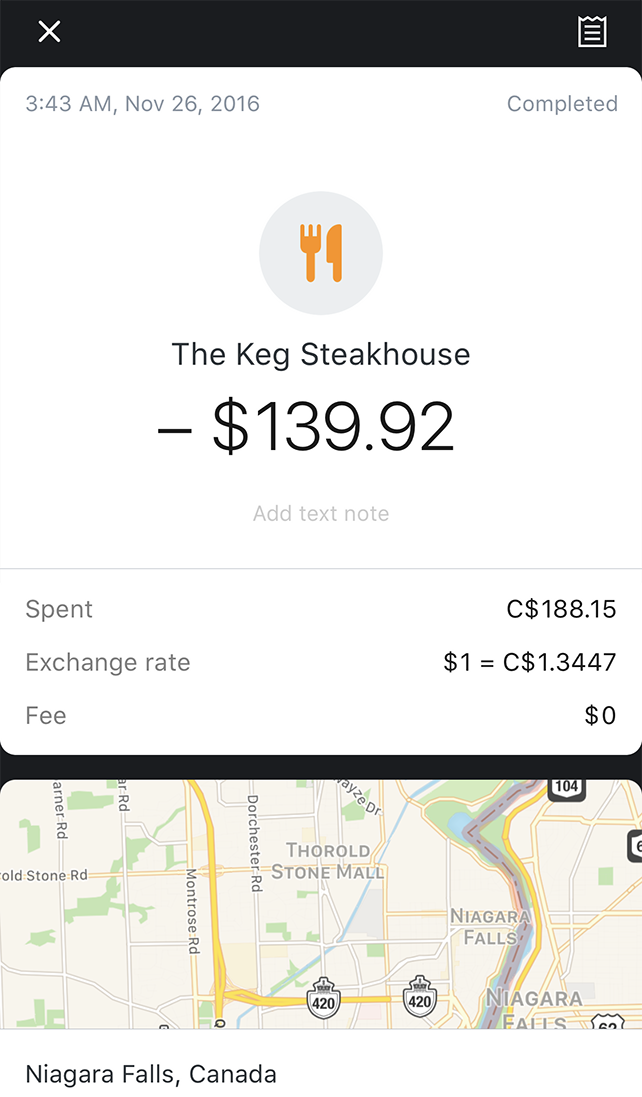

Transaction Information

Each time you use the card you will receive a push notification and you can view all past transactions (including declined transactions) easily in the app.

In addition to the information you would expect it shows the exchange rate (if not USD, GBP or EUR) as well as a map location showing the location of the transaction.

This location is based on the merchant, not where your iPhone was at the time of the transaction.

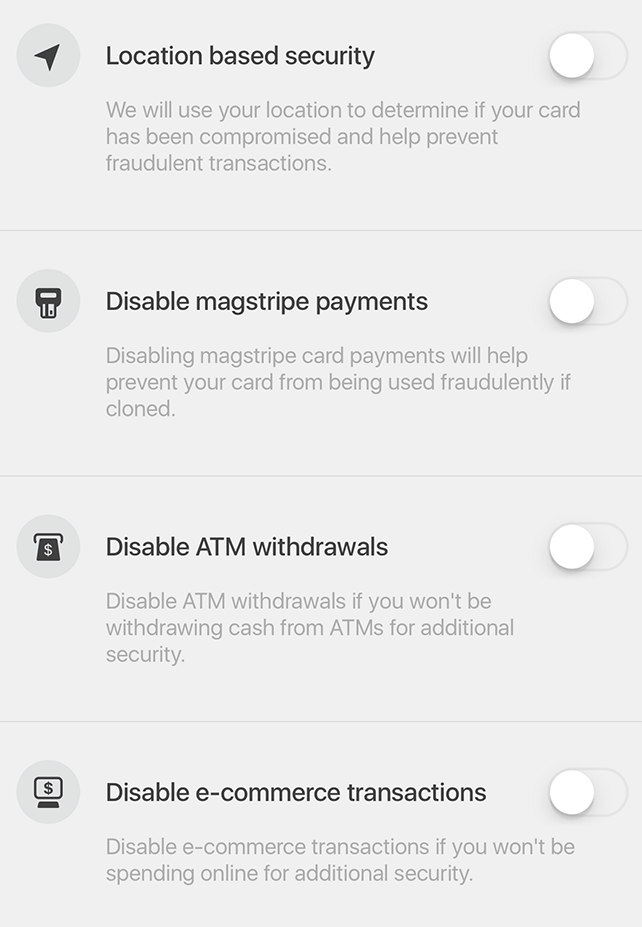

Security

Revolut offers very granular control of your card (e.g. allow/disallow eCommerce, ATM transactions, location based security etc) as well as the ability to Block/Unblock the card instantly within the app if it's lost or simply if you don't have it with you.

Revolut offers very granular control of your card (e.g. allow/disallow eCommerce, ATM transactions, location based security etc) as well as the ability to Block/Unblock the card instantly within the app if it's lost or simply if you don't have it with you.

It's worth noting that I had a bit of an issue with the Location based security as detailed below, so I'd recommend switching this off if you experience unexpected issues, especially if you're using US gas stations.

Where it works

Almost everywhere; I've used it online to pay for things in USD (e.g. on Kickstarter) and in person to pay for my hotel, dinner in many restaurants, theatre tickets, (some) gas stations and stores in the USA without any issue.

I was even able to withdraw cash in USD, without any nasty surprises in exchange rates or foreign transaction fees.

Where it didn't work (mainly gas stations) I then tried to use Curve (which invariably didn't work either where Revolut doesn't) and then, finally, Amex, which always work but stings you with a 3% charge.

Where it didn't work

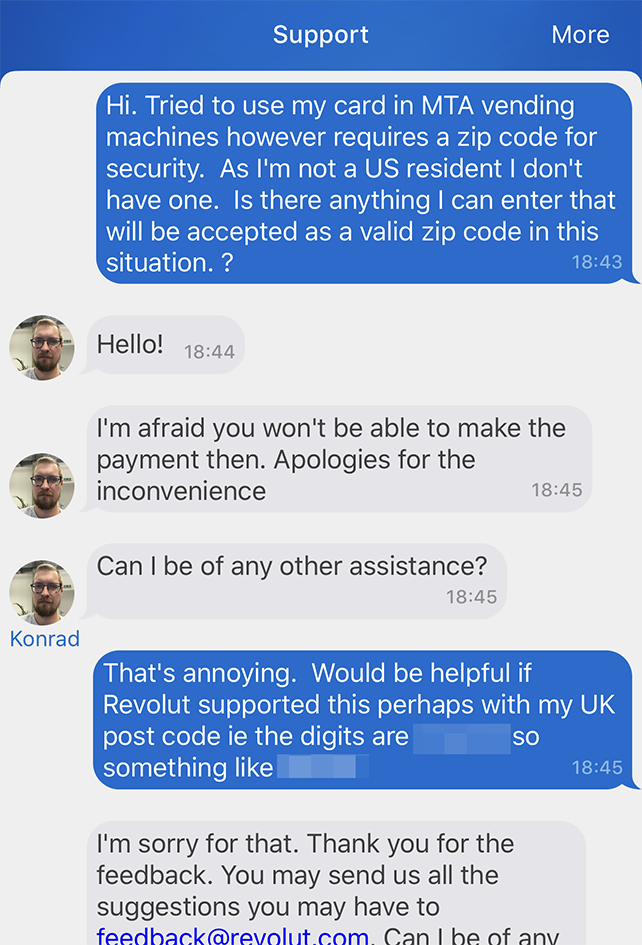

NYC MTA Ticket Offices (and Ticket Machines), and some other gas stations. Notably these places required the entry of a ZIP code together with the card - and I don't have one.

For non-US residents it would make sense for Revolut to allow you to provide a 6 digit security code in the app that could be entered when a ZIP code is requested, or allow us to use solely the digits from our UK postcode e.g. A12 3BC would be come 00000123 or something.

The Revolut support team (accessed by an IM-style chat in the app) were quick to confirm this was the case, but less receptive to feedback which was a bit disappointing.

In both these places I tried using the Curve card (which also failed) before eventually resorting to my Amex which (presumably because it identified as a GBP card) didn't require this validation, but also costs considerably more to use.

I didn't even try it for things like car rental, the extra protection afforded by using a card like Amex for these transactions makes it worth the small increased fee.

Location-based Security

In principle, Revolut's location-based security is great but it has a significant drawback... refunds.

Due to the prepaid nature of the card, some gas stations insisted on debiting an amount (in my case $40) before fuelling the car, and then refunding the remaining balance ($22.97)

This worked perfectly, except the $22.97 refund seemed to break the location-based security for any subsequent transactions as this refund was from a different area.

This was annoying as the next $200 or so of transactions were all declined, forcing me to use an alternative card until I worked out the reason for this and turned off this overzealous protection.

Cheaper than the Travel Exchange

I spent around $3,189 in total. The best deal at the time was M&S Money (£1 = 1.2114 USD) which makes this a total of £2,632. Obviously though, if using cash, you don't know how much you'd spend, and they sting you when you come home too ...

So, assume £3000 (giving $3,634.42) and then coming back with $445 which, at their buy-back rate would be £324. End result, $3,189 would cost £2,676

With Revolut, you get the rate on the day you exchange it, so it's a little harder to calculate but in total (after refund to my UK balance when I got home) I spent £2,547 with Revolut. An effective rate of £1 = 1.252 USD!

So this is a saving of a little over £100, it's not huge, but to be honest I'd have paid £100 more just for the convenience of using a card.

Compared to my Other Cards

Let's be honest, I'd never use a Travel Exchange, the thought of carrying $1000s of foreign currency just doesn't appeal. So if I hadn't used Revolut, I'd have likely used Amex.

Now, in the US, Amex makes a big deal that you can "Shop like a local" with no foreign transaction fees. Here in the UK the situation is a little different;

If you make a transaction in a foreign currency, you will be charged a non-sterling transaction fee of 2.99% on the transaction amount. If you use your Card to withdraw cash abroad a cash fee of 3% of the withdrawal amount or £3 (whichever is greater) will be payable in addition to the non-sterling transaction fee. You may need to enrol in order to withdraw cash and we may apply restrictions on the amount or the frequency in which you use the cash advance facility, please visit americanexpress.com/uk/cash for further information.

The actual value would have been different (as I've estimated this based on the average Amex rate for the trip, which was 1.229, but a total spend of $3,189 USD would have been approximately £2,672.37 (including a £77.58 non-sterling transaction fee) – remarkably this is only very slightly more than the "commission free" foreign exchange, but considerably more than Revolut.

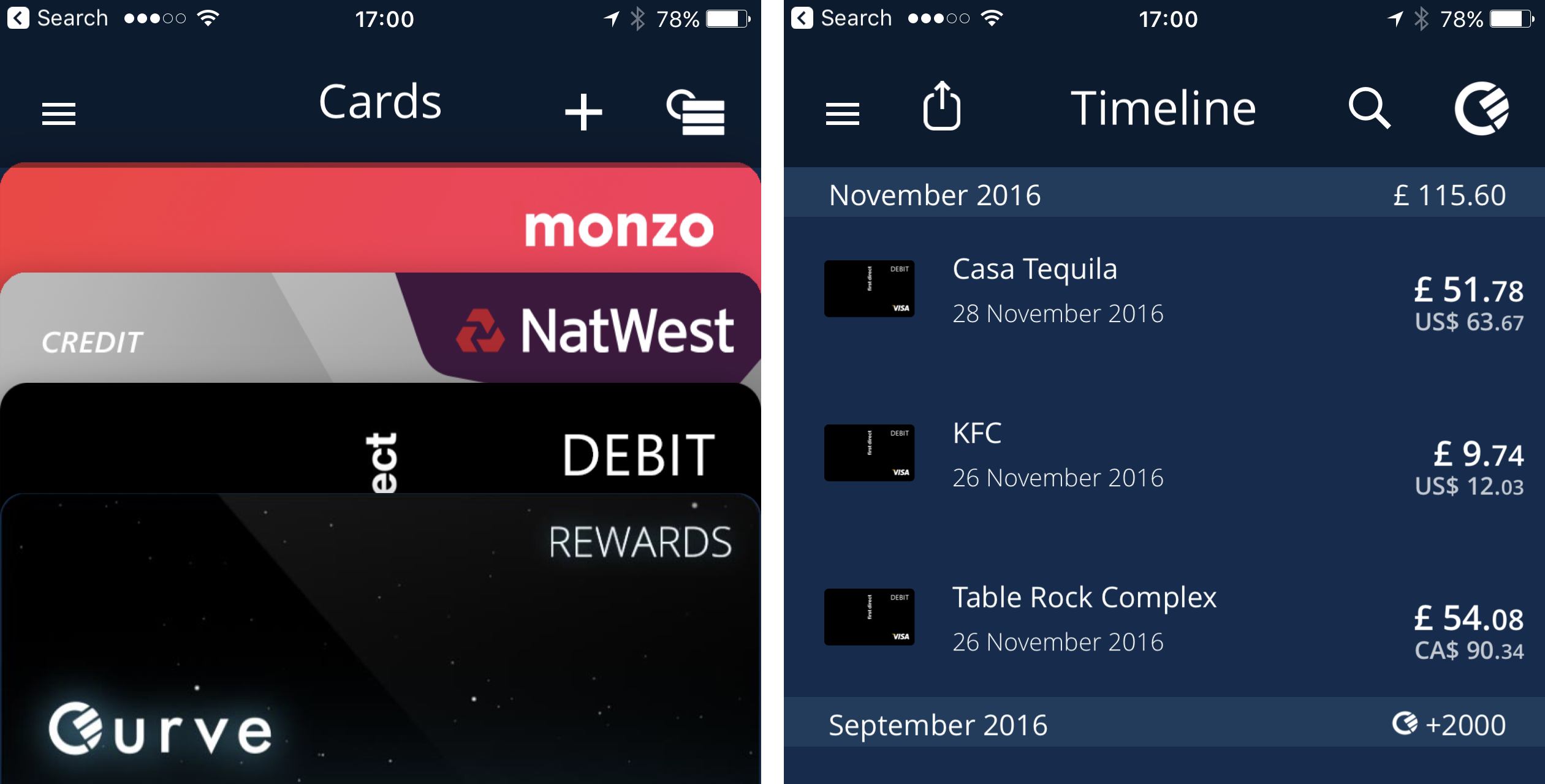

Ahead of the Curve?

I also have a Curve card and, to be honest, given Revolut's focus on international transactions and the fact I can maintain a USD balance on the card it was relegated to being my second-choice card for the trip.

Curve is different from Revolut (and any other prepaid card) in that it is linked to your existing cards and transactions are essentially 'proxied' across them. You can switch between multiple cards, using the app, allowing you to use your Curve card in place of any of your usual debit or credit cards, which is really rather neat.

Since Curve disabled support for Amex (one of their big - heavily lauded - USPs when they launched!) I've rarely used it although I did use it for three transactions when I was away (when Revolut failed due to location security) - the average of these was a rate of 1.23 which is reasonable.

The big thing for me and Curve, like many others, was Amex. If this integration had still been in place I'd have used Curve exclusively this trip, even with the slightly less favourable rates.

If you want to try Curve, use promo code DWR9R and get £5 Free – https://www.imaginecurve.com/getcurve

Get Revolut

There's a bit of a waiting list for a Revolut card, but if you want one you can get one here (the referral link doesn't give me anything, but I do think it reduces the wait in the queue!)

If you're travelling soon to the US, Europe, (or the UK if you're from the US or Europe I guess) then I'd highly recommend it and (for now) it's completely free so you've got nothing to lose :)

Whatever you do don't use your bank card or foreign exchange when travelling abroad, there are so many better options now!